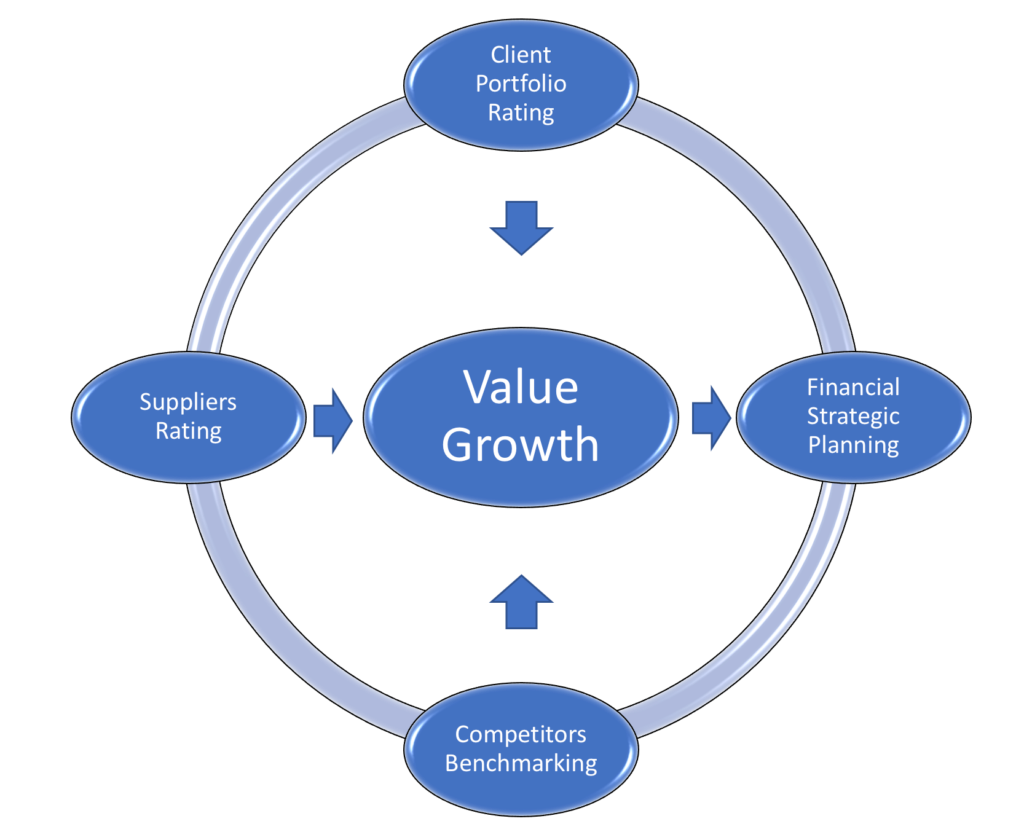

Equita K Finance strategy for its clients’ value growth is based on four pillars:

Clients Portfolio Rating

Clients Portfolio Rating allows you to track clients credit risk, determine a dynamic credit for each customer, intervene in advance on risk situations, and properly manage credit policies. It is also an excellent tool for maximizing a credit portfolio towards the banking and financial system.

Suppliers Rating can assess the operational risk associated with suppliers, based on their financial strength, their strategic relevance to the company, and their degree of substitutability. Classify cluster vendors to apply diversified management policies to consolidate relationships with key vendors, support the development of suppliers that deserve it, and induce them to gradually replace risky suppliers.

Suppliers Rating

Competitors Benchmark

Competitors Benchmark allows you to analyze the performances of your reference competitors, evaluate their strategies in terms of value creation and financial risk management, identify their major drivers. Through a series of maps, the company’s positioning is compared to its competitors. Therefore this analysis highlight the points of advantage and criticality, the alternative paths followed by the competitors, and the more consciously constructing a strategic route for value creation.

Financial Strategic Planning allows you to transform management control into a Value-Rating and Rating compass-driven company guidance tool. Growth means increasing the value of the company by managing its financial risk. It allows to manage financial planning and financial control in strategic perspective by bridging the information that comes from Customer Rating, Rating Suppliers, and Benchmark Competitors, and comparing them with company business results.

Financial Strategic Planning