- Home

- Filippo Guicciardi interviewed on ˝new normality˝

Filippo Guicciardi, CEO of K Finance, interviewed on ClassCNBC, talks about managing the business in times of ˝new normality˝.

Archives

- March 2024

- February 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- May 2023

- April 2023

- March 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- February 2022

- December 2021

- November 2021

- September 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- July 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- July 2019

- June 2019

- April 2019

- February 2019

- January 2019

- November 2018

- October 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- December 2017

- October 2017

- September 2017

- May 2017

- March 2017

- February 2017

- January 2017

- December 2016

- October 2016

- September 2016

- July 2016

- April 2016

- February 2016

- January 2016

- November 2015

- October 2015

- June 2015

- January 2015

- December 2014

- November 2014

- September 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- December 2013

- November 2013

- September 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- November 2012

- October 2012

- September 2012

- July 2012

- June 2012

- April 2012

- March 2012

- February 2012

- January 2012

- October 2011

- July 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- October 2010

- July 2010

- May 2010

- April 2010

- March 2010

- December 2009

- November 2009

- October 2009

- June 2009

- March 2009

- February 2009

- January 2009

- November 2008

- June 2008

Categories

recent news

EQUITA K Finance (Clairfield Italy) advisor to Eredi Campidonico in the sell of EC Rete to Retitalia

Eredi Campidonico SpA has sold its EC Rete branch of business, which includes 22 service stations based in Piedmont, to Retitalia SpA. Deatils in the “M&A deals” section of the website.

- Read more

- Thursday March 14th, 2024

EQUITA K Finance (Clairfield Italy) advisor to Arcadia in the investment by GM Leather in Chiorino Technology

G.M. Leather, an Italian group listed on Euronext Growth Milan and strategic partner for the supply of leathers to leading brands in the luxury (leather goods and footwear) and lifestyle (medium and high-end furniture) sectors, has finalised an agreement with partners Arcadia SGR S.p.A. and Marco Toscano, for a 18.92% investment in Chiorino Technology S.p.A....

- Read more

- Thursday February 1st, 2024

Clairfield Australia and EQUITA K Finance (Clairfield Italy) advisor to EyeQ in the sell to ExilorLuxottica

EssilorLuxottica completed its acquisition of EyeQ Optometrists, with Clairfield Australia and Italy (Equita K Finance) acting as the exclusive financial advisor to EyeQ Optometrists Limited. Details in the “M&A deals” section of the website.

- Read more

- Thursday February 1st, 2024

EQUITA K Finance (Clairfield Italy) and EQUITA SIM advisor to SEC Newgate in the sell to Investcorp

Investcorp, a leading global alternative investment firm, announced that it has invested approximately 100 million US dollars for a majority stake in SEC Newgate, a global strategic communications and advocacy group. EQUITA K Finance and EQUITA SIM were the financial advisors to SEC Newgate. Details in the “M&A deals” section of the website.

- Read more

- Friday December 29th, 2023

Equita K Finance (Clairfield Italy) and Clairfield France advisors to Gruppo Fontana in the acquisition of INTERMETAL

Fontana Group, a world leader in high-quality fasteners, through its Fontana Fast Trade division specializing in the distribution of fastening systems (standard and special) for the entire EMEA market, with a focus on marketing and services, reaches a significant milestone in its strategic development plan with the acquisition of INTERMETAL in France. Details in the...

- Read more

- Thursday November 23rd, 2023

Equita K Finance (Clairfield Italy) advisor to Ricami NBM in the sell to Group Star New Generation

Star New Generation Group (SNG Group), 70% owned by Star Capital through the Star IV – Private Equity Fund and 30% by the Marzioni family, has acquired 80% of the company Ricami NBM S.r.l. Details in the “M&A deals” section of the website.

- Read more

- Tuesday November 14th, 2023

Equita K Finance (Clairfield Italy) advisor to VIP Air Empowerment in the sell to Multi-Wing

Multi-Wing Group A/S has acquired 100% of the shares in VIP Air Empowerment Srl, a long-time customer of Multi-Wing’s impellers with a strong position in the Italian axial fan solution market. Deatils in the “M&A deals” section of the website.

- Read more

- Thursday October 19th, 2023

Clairfield Meeting Milano 2023

Here’s the video! It has been a pleasure for Equita K Finance, Italian member of Clairfield, to host the Clairfield Meeting 2023 here in Milano. Over 80 Clairfield partners and 15 Clairfield Academy participants from 21 offices around the globe gathered for two days of information sharing, elevated learning, networking, workshops, and external speakers.

- Read more

- Wednesday October 4th, 2023

Equita K Finance (Clairfield Italy) advisor to Rosa Sistemi in the sell to Timken

The Timken Company, a global leader in bearings and industrial motion products, has acquired Rosa Sistemi SpA, an Italian company designing and manufacturing roller guideways, linear bearings, customized linear systems and actuators, commercialized ball guideways and precision ball screws. Details in the “M&A deals” section of the website.

- Read more

- Monday October 2nd, 2023

Equita K Finance (Clairfield Italy) advisor to Lotras in the sell to CFI

CFI, the first national independent rail operator and 92.5% controlled by the F2i infrastructure fund, has acquired from the De Girolamo family 90% of the capital of Lotras, a leading operator in the multimodal rail and road transport sector. Details in the “M&A deals” section of the website.

- Read more

- Friday September 29th, 2023

Equita K Finance (Clairfield Italy) advisor to Tecnoplast in the sell to DeA Capital Sviluppo Sostenibile

Sviluppo Sostenibile, a private equity fund specialising in investments in Italian SMEs promoting ESG issues, managed by DeA Capital Alternative Funds SGR, has acquired a majority stake in Tecnoplast S.r.l. Details in the “M&A deals” section of the website.

- Read more

- Friday September 29th, 2023

Equita K Finance (Clairfield Italy) advisor to RS Service in the sell to CVA

CVA Group (Compagna Valdostana delle Acque), a leading operator in the green energy sector and the only integrated producer operating exclusively on renewable sources, has acquired, through its vehicle CVA Smart Energy, 70% of the company RS Service, based in Genova (Italy), active in the design, construction and maintenance of electrical and mechanical systems. Details...

- Read more

- Thursday September 28th, 2023

Equita K Finance (Clairfield Italy) advisor to Plast.met in the sell to Decorluxe

Decorluxe Group, the platform of surface processing of packaging for perfumery, cosmetics and beverages of Ethica Global Investments, announces the acquisition of Plast.met. Details in the “M&A deals” section of the website.

- Read more

- Thursday September 28th, 2023

Equita K Finance (Clairfield Italy) advisor to ASO H&P Group for a Euro 23m financing

ASO H&P Group, world leader in chrome plated bars in the hydraulic and pneumatic sectors, has successfully signed an agreement with a pool of banks formed by BNL BNP Paribas, as agent bank, UniCredit, Banco BPM and Banca Ifis for a Euro 23 million loan to support a greenfield investment in India aimed at strengthening...

- Read more

- Tuesday August 29th, 2023

Equita K Finance (Clairfield Italy) and Clairfield France advisor to Sotralu in the acquisition of FR Accessories

Sotralu Group, supported by its majority shareholder Bridgepoint Development Capital, reaches a significant milestone in its strategic development plan with the acquisition of FR Accessories in Italy. Details in the “M&A deals” section of the website.

- Read more

- Friday July 28th, 2023

Equita K Finance (Clairfield Italy) advisor to Clessidra in the acquisition of Everton

Clessidra Private Equity SGR – one of Italy’s largest private equity firms focused on the mid- to high-end market – announced the acquisition of Everton, a leading tea and infusion specialist, from a group of investors led by Cronos Capital Partners. Details in the “M&A deals” section of the website.

- Read more

- Friday May 26th, 2023

Equita K Finance (Clairfield Italy) advisor to Fonderia Boccacci in the sell to Consilium

Consilium, through Consilium Private Equity Fund IV, acquired a majority stake in Fonderia Boccacci S.p.A. from the Boccacci family, which will retain a significant minority shareholding and will continue to collaborate operationally, together with key members of top management (including the current CEO), with the aim of continuing the company’s ambitious growth path. Deatils in...

- Read more

- Thursday April 6th, 2023

Equita K Finance (Clairfield Italy) advisor to Customs Support in the acquisition of Errek

Customs Support, the leading digital customs broker in Europe, part of Castik Capital portfolio companies, announces the acquisition of Errek Srl. Details in the “M&A deals” section of the website.

- Read more

- Thursday March 30th, 2023

Equita K Finance (Clairfield Italy) advisor to Optoplast in the sell to Star Capital

Star Capital S.G.R. S.p.A., through the Star IV Private Equity Fund, has finalised the acquisition of a 70% stake in Optoplast S.p.A., a company focused on the production of connectivity for fibre optic cables for the Telecom & Broadcasting industries. Details in the “M&A deals” section of the website.

- Read more

- Monday January 30th, 2023

Equita K Finance (Clairfield Italy) advisor di Gemini RX nella vendita a SIMA ITA

SIMA ITA has acquired 100% of Gemini RX, one of the most renowned facilities of excellence in diagnostics in the province of Brescia (Italy). Details in the “M&A deals” section of the website.

- Read more

- Friday January 20th, 2023

Equita K Finance (Clairfield Italy) advisor to adesso SE in the purchase of WebScience

adesso SE, listed on the Dortmund stock exchange with a turnover in excess of Euro 800 million, strengthens its position in the Italian market with the acquisition of WebScience s.r.l., the Italian Agile Digital Factory. Details in the “M&A deals” section of the website.

- Read more

- Thursday January 19th, 2023

Equita K Finance (Clairfield Italy) advisor to E.P. Elevatori Premontati in the sell to Riello Investimenti

Riello Investimenti Partners SGR finalised the closing of the acquisition of 75% of E. P. Elevatori Premontati, a leading Tuscan company in the design, production and sale of lifting platforms. Equita K Finance (Clairfield Italy) was advisor to the sellers. Details in the “M&A deals” section of the website.

- Read more

- Friday January 13th, 2023

Equita K Finance (Clairfield Italy) exclusive financial advisor to e-Novia

Equita K Finance (Clairfield Italy) advised e-Novia Spa, as exclusive financial advisor, on the capital raising, private placement and listing on the Euronext Growth segment of the Milan Stock Exchange. Details in the “M&A deals” section of the website.

- Read more

- Friday December 16th, 2022

Equita K Finance (Clairfield Italy) advises the shareholders of Sudoku S.r.l. in the sale to Keesing Italia S.r.l.

Sudoku S.r.l., Italian leader in sudokus and logical puzzles, was acquired by Keesing Media Group B.V. Details in the “M&A deals” section of the website.

- Read more

- Wednesday November 9th, 2022

Equita K Finance (Clairfield Italy) advisor to Vega Carburanti in the sell of Levante to Amegas (Energas group)

Vega Carburant sold its Levante business unit, which includes 9 automotive fuel distribution plants (8 of which are located in the region Puglia and one in Tuscany for a total of approximately 100 million litres per year of dispensed fuel) to Amegas SpA, a company belonging to the Zetagas / Energas group. Details in the...

- Read more

- Friday October 28th, 2022

Equita K Finance (Clairfield Italy) advisor to Customs Support in the acquisition of M.C.S. (Mediterranean Customs Services)

Customs Support, the leading digital customs broker in Europe, part of Castik Capital portfolio companies, announces the acquisition of Mediterranean Customs Services (M.C.S.). Details in the “M&A deals” section of the website.

- Read more

- Wednesday October 5th, 2022

Equita K Finance (Clairfield Italy) advisor to Sirti in the sell of Sirti Energia to mutares

Sirti S.p.A., controlled by Pillarstone (a KKR Group platform specializing in turnarounds), has completed the sale of 100 percent of Sirti Energia S.p.A. to Mutares SE & Co. KGaA. Sirti was advised by Equita K Finance (Clairfield Italy), part of Equita Group, as financial advisor. Details in the “M&A deals” section of the website.

- Read more

- Monday September 26th, 2022

Equita K Finance (Clairfield Italy) advisor to Ambienta in the buy of Calpeda

Ambienta SGR SpA, one of Europe’s largest asset managers entirely focused on environmental sustainability, announces that Calpeda SpA, a leading global manufacturer of pumps, motors and systems for the integrated water cycle, is joining its platform company Wateralia SpA. With the industrial integration between Calpeda and Caprari SpA, whose acquisition was performed in February 2021,...

- Read more

- Tuesday July 26th, 2022

Equita K Finance (Clairfield Italy) advisor to Fidia in the capital raising from Fai and Negma

Futuro all’impresa (Fai), an advisory and investment company specialising in M&A and restructuring transactions, and Negma Group, an investor specialising in hybrid equity and debt instruments based in Dubai and London, are investing in Fidia S.p.A. to initiate the arrangement with creditors as a going concern. Details in the “M&A deals” section of the website.

- Read more

- Friday August 5th, 2022

Equita K Finance (Clairfield Italy) advisor to Tollegno 1900 in the sell of its yarn division to Indorama Ventures

Tollegno 1900 S.p.A. sold its yarn division to Indorama Ventures Public Company Limited (IVL), a listed company based in Thailand and one of the world’s leading petrochemical producers with a global manufacturing presence in Europe, Africa, the Americas and Asia Pacific. Details in the “M&A deals” section of the website.

- Read more

- Monday July 4th, 2022

Equita K Finance (Clairfield Italy) advisor to Salice in the sell of a majority stake to Cobepa

Third-generation family shareholders of Salice SpA sold the majority of the Group to Cobepa S.A., a Belgian investment company backed by large entrepreneurial European families. The transaction is a pivotal moment in the Group’s family longstanding history, as Cobepa’s entry marks a new phase of investment and development. Details in the “M&A deals” section of...

- Read more

- Wednesday June 29th, 2022

Equita K Finance (Clairfield Italy) advisor to Famar in the sell to Holding Moda

Holding Industriale (Hind), a company that invests in small and medium-sized companies representative of ‘Made in Italy’, has acquired – through its subsidiary Holding Moda – a majority stake in Famar Srl, a company based in Ferrara that designs and produces women’s and men’s clothing collections for the most prestigious international fashion brands, with a...

- Read more

- Wednesday May 18th, 2022

Equita K Finance (Clairfield Italy) advisor to GF Garden in the sell to EXEL Industries

As part of the strong growth of its activities in the Garden sector, EXEL Industries bought 100% of the company GF Garden from the Italian family group FISPA Srl. Details in the “M&A deals” section of the website.

- Read more

- Wednesday February 16th, 2022

Equita K Finance (Clairfield Italy) advisor to Customs Support on the purchase of Mollica

Customs Support, one of Europe’s leading customs and digital partners and a portfolio company of Castik, acquired Mollica and MACC (Mollica Group). Details in the “M&A deals” section of the website.

- Read more

- Monday December 27th, 2021

Equita K Finance (Clairfield Italy) advisor to Barbieri & Tarozzi Group on the sell of Best Surface to Laminam

Laminam, global leader in the production and marketing of large format ceramic slabs for the high-end architecture and interior design sectors, owned by Alpha Private Equity, and the Barbieri & Tarozzi Group, a manufacturer of technology and complete plants serving the ceramic industry, announce that they have reached an agreement for the acquisition of 100%...

- Read more

- Thursday December 23rd, 2021

Equita K Finance (Clairfield Italy) advisor to Aurora on the sell to Cy4Gate

Cy4Gate S.p.A. (EGM: “CY4”) – a company active in the cyber intelligence and security market with a diversified offering of proprietary technologies, announces that it has signed a preliminary agreement for the acquisition of 100% of Aurora S.p.A., at the head of a group that is a market leader in Italy, including RCS, and one...

- Read more

- Friday December 17th, 2021

Equita K Finance (Clairfield Italy) advisor to Ivela on the sell to Star Capital

Star Capital SGR S.p.A., through the holding company Starlight Group, a subsidiary of Star IV Private Equity Fund, has acquired control of Ivela, a company active in the production and marketing of lighting fixtures made in Italy. Details in the “M&A deals” section of the website.

- Read more

- Wednesday December 15th, 2021

Equita K Finance (Clairfield Italy) advisor to Limonta in the sell of 25% to TIP

The Limonta family sold to Tamburi Investment Partners S.p.A. (“TIP”), an independent and diversified industrial group listed on the STAR segment of the Italian Stock Exchange, 25% of Limonta S.p.A., partly through a capital increase and partly through the purchase of shares. Details in the “M&A deals” section of the website.

- Read more

- Thursday December 2nd, 2021

Equita K Finance (Clairfield Italy) advisor to Vertis and to the other shareholders in the sell of Selematic to Mandarin Capital Partners

The independent Private Equity firm Mandarin Capital Partners acquires 63.7% of Selematic S.p.A., an Italian company leader in the production of automatic secondary packaging machines for the food, pet food and disposable sectors, from Vertis SGR and from the other shareholders. Details in the “M&A deals” section of the website.

- Read more

- Tuesday November 30th, 2021

Equita K Finance with Sevendata in KF Economics for AI development in Fintech

Under the agreement, SevenData acquires a 60% majority stake in KF Economics. The founding partners of KFE (including Equita K Finance) will remain as minority shareholders with a 40% stake. Experienced figures such as Paolo Lasagni, Francesca Grasselli and Francesco Pattarin, co-founding partners of KFE together with Equita K Finance, will therefore continue to contribute...

- Read more

- Friday November 26th, 2021

Equita K Finance (Clairfield Italy) advisor to BH in the acquisition of IVAR

BH S.r.l., the holding company of the Bertolotti family which heads the IVAR Group, has acquired 40% of IVAR S.p.A., a company already controlled by BH and one of the leading operators in the design and manufacture of energy-efficient heating and sanitary systems. The shareholding was sold by Begetube NV, a Belgian distributor of heating,...

- Read more

- Thursday November 25th, 2021

Equita K Finance (Clairfield Italy) advisor to Metra in the acquisition of Rustici

Metra Group of Brescia, a global manufacturer of extruded aluminum, recently acquired by the American investment fund KPS Capital Partners, completed the acquisition of 100% of Rustici S.p.A., an historic industrial company in Tuscany (Italy) in the production of aluminum structural components for the railway industry. Deatils in the “M&A deals” section of the website.

- Read more

- Wednesday September 22nd, 2021

Equita K Finance (Clairfield Italy) advisor to Ser.Nav. in the sell to Customs Support

Ser.Nav. Group, one of the Italian leaders in the customs operations, was acquired by the Dutch group Customs Support, a Castik Capital portfolio company. Details in the “M&A deals” section of the website.

- Read more

- Friday June 18th, 2021

Equita K Finance (Clairfield Italy) advisor to Camicissima in the purchase of Nara Camicie

Fenicia Spa, the parent company of the well-known brand Camicissima, acquires Nara Camicie, a brand owned by Passaggio Obbligato SpA, which belongs to the Annaratone and Gaggino families as well as to the designer Mario Pellegrino. Details in the “M&A deals” section of the website.

- Read more

- Wednesday June 16th, 2021

Equita K Finance (Clairfield Italy) advisor to Aksia in the acquisition of La Pizza +1

Aksìa Capital V, a fund managed by Aksìa Group SGR, acquires, through its investee Valpizza, La Pizza +1, a company with premium quality positioning, leader in Italy in the production of rectangular pizza, pinsa, focaccia, fresh and room temperature. Details in the “M&A deals” section of the website.

- Read more

- Monday May 31st, 2021

Equita K Finance (Clairfield Italy) advisor to Aksia in the acquisition of C&D (Ghiottelli)

Aksìa Capital V, a fund managed by Aksìa Group SGR, acquires, through its investee Valpizza, a majority stake of C&D, an Apulian company leader in the production of pre-fried frozen oven-baked gastronomic specialties. Details in the “M&A deals” section of the website.

- Read more

- Wednesday May 26th, 2021

Equita K Finance (Clairfield Italy) advisor to OME Group in the sell to IGI

The independent private equity firm IGI Private Equity acquires 73% of OME Metallurgica Erbese, Stampinox and Hexagonal (OME Group), leading companies in the production of fastening systems for the oil & gas and power generation sectors. Details in the “M&A deals” section of the website.

- Read more

- Wednesday May 19th, 2021

Equita K Finance (Clairfield Italy) advisor to EDIF in the sell to Megawatt Group

The shareholders of EDIF S.p.A. have sold a majority stake to Megawatt Group, a leading operator in the electrical equipment distribution market in southern and central Italy. Details in the “M&A deals” section of the website.

- Read more

- Tuesday April 6th, 2021

Equita K Finance (Clairfield Italy) and Orbis Partners (Clairfield UK) advisor to Lucart in the acquisition of ESP

Lucart S.p.A., the Lucart Group head company based in Porcari (Lucca, Italy), has announced the acquisition of 100% of the share capital of ESP Ltd (Essential Supply Products Ltd.), the leading independent manufacturer of tissue paper products for the Away from Home market in Great Britain. Details in the “M&A deals” section of the website.

- Read more

- Tuesday March 2nd, 2021

Equita K Finance (Clairfield Italy) advisor to Caprari in the entry of its capital of Ambienta

Caprari, a company with 75 years of history and leader in advanced solutions for the management of the integrated water cycle with three production plants (two in Italy and one in Turkey) and a direct presence in international markets with numerous subsidiaries, has announced the entry in its capital of Ambienta, Europe’s largest private equity...

- Read more

- Monday February 22nd, 2021

M&A during the pandemic

Clicking on the link, you find an interview in Italian with our CEO Filippo Guicciardi, published on startup.info, who tells us how to do M&A during the pandemic.

- Read more

- Monday February 1st, 2021

Equita K Finance (Clairfield Italy) advisor to La Patria in the acquisition of Vigilanza Sevi

La Patria, a portfolio company of A&M Capital Europe, a London based middle-market Private Equity firm managing Euro 650 million of equity capital, has acquired Vigilanza Sevi, an Italian provider of alarm and security surveillance services. Details in the “M&A deals” section of the website.

- Read more

- Friday January 22nd, 2021

Equita K Finance (Clairfield Italy) advisor to Everton in the entry of its capital by Cronos Capital Partners and other private investors

Everton S.p.A., an Italian food & beverage leader in the production of tea, herbal tea, infusions and instant beverage with production plants in Italy, India and Croatia, and a commercial joint-venture agreement in the United States, has sold a majority stake to Cronos Capital Partners and to other private investors. Equita K Finance (Clairfield Italy)...

- Read more

- Thursday December 3rd, 2020

Equita K Finance (Clairfield Italy) advisor to Sicer in the sell to Azimut

Azimut Libera Impresa SGR- on behalf of the Private Equity fund Demos 1 – has completed the purchase of 65% of Sicer S.p.A., a company based in Fiorano Modenese (Emilia Romagna region) and one of the world leaders in the design, production and distribution of special chemical products for the glazing and decoration of ceramic...

- Read more

- Thursday November 26th, 2020

Equita K Finance (Clairfield Italy) advisor to San Cristoforo in the sell to Bianalisi

Bianalisi acquired 100% of San Cristoforo, a diagnostic and therapeutic clinic from the current shareholders. Equita K Finance (Clairfield Italy) was advisor to the sellers in this transaction. Details in the “M&A deals” section of the website.

- Read more

- Wednesday November 11th, 2020

Equita K Finance (Clairfield Italy) advisor to Omav in the sell to SMS Group

SMS Group has completed the acquisition of Omav S.p.A., supplier of aluminium extrusion lines, acquiring the remaining 75% of the capital still owned by the previous shareholders. Equita K Finance (Clairfield Italy) has been advisor to the sellers. Details in the “M&A deals” section of the website.

- Read more

- Thursday October 8th, 2020

Equita K Finance (Clairfield Italy) advisor to VOMM in the sell to Aksia

Aksia Group sgr, through Aksia V, acquired a controlling stake (65%) in VOMM, an Italian leading Group in the production of processes industrial plants in the environmental, chemical-pharmaceutical and food sectors. Equita K Finance advised VOMM. Details in the “M&A deals” section of the website.

- Read more

- Wednesday September 16th, 2020

K Finance (Clairfield Italy) advisor to Vittoria in the sale to Wise Equity

The shareholders of Vittoria Group have sold 100% of the Group, world leader and most innovative forerunner among the manufacturers of high quality bicycle tyres, to Wise Equity, Private Equity fund investing in Italian SMEs since 2000. Details in the “M&A deals” section of the website.

- Read more

- Thursday July 23rd, 2020

EQUITA ACQUIRES THE MAJORITY OF K FINANCE

• EQUITA, THE LEADING INDEPENDENT INVESTMENT BANK IN ITALY, LISTED ON THE ITALIAN STOCK EXCHANGE AMONG THE COMPANIES IN THE “STAR” SEGMENT, SIGNS AN AGREEMENT TO ACQUIRE K FINANCE, AN INDEPENDENT CORPORATE FINANCE BOUTIQUE ACTIVE FOR MORE THAN 20 YEARS, THUS STRENGTHENING INVESTMENT BANKING ACTIVITIES AND ACCELERATING THE ACHIEVEMENT OF THE OBJECTIVES OF THE STRATEGIC...

- Read more

- Friday July 10th, 2020

K Finance (Clairfield Italy) advisor to IGI in the sell to Wise Equity

IGI Private Equity and the management have sold 100% of Fimo Group, the European leader in components and systems applied in telecommunications infrastructure, to Wise Equity, a PE fund that has been investing in Italian SMEs since 2000. Details in the “M&A deals” section of the website.

- Read more

- Wednesday July 8th, 2020

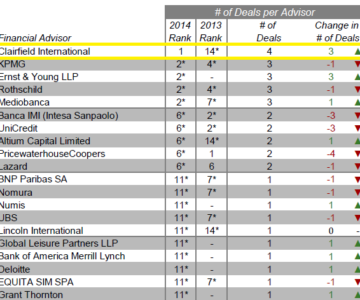

K Finance – Clairfield International climbs the mergermarket rankings

K Finance – Clairfield International has an excellent result and is 12th in the Italian 1H20 mergermarket ranking. It improved by 16 positions compared to the same period last year, despite the emergency due to the pandemic.

- Read more

- Tuesday July 7th, 2020

K Finance (Clairfield Italy) advisor to CEI in the sell to Alto Partners

Alto Partners Sgr, despite the global emergency period, bets on the Italian industry and buys CEI Costruzione Emiliana Ingranaggi group, based in Anzola dell’Emilia (Bologna) and active since 1969 in the marketing of undercarriage components for the truck spare parts sector. Details in the “M&A” section of the website.

- Read more

- Monday May 11th, 2020

Filippo Guicciardi at M&A Circus

In this episode of M&A Circus Laura Morelli tackles the M&A mid-cap market with Filippo Guicciardi, founder and CEO of K Finance. In 2008 “there was an immediate block and in 2009 M&A was dead and buried because there was fear, there was no confidence and liquidity had disappeared and there were not those trends...

- Read more

- Friday May 8th, 2020

K Finance (Clairfield Italy) advisor to the minority shareholders of 2C Solution, controlled by Namirial, in the sell to the controlling company

K Finance (Clairfield Italy) assisted Mr Davide Coletto and Mr Enrico Checchin, minority shareholders of 2C Solution, controlled by Namirial, in the sale of their shares to the parent company, which in turn was acquired at the same time by the PE fund Ambienta. Mr Coletto and Mr Checchin reinvested together with the founders of...

- Read more

- Friday May 8th, 2020

Filippo Guicciardi at ELITE’s Digital Talks

Filippo Guicciardi, CEO of K Finance, is the protagonist of an episode of Elites’sDigital Talks, as part of the initiative #ELITEtogether: ELITE alongside Italian companies – Tools, services and support to deal with the emergency. This pill, entitled “M&A: an opportunity to restart?“, describes the evolution of the M&A market at the time of Covid...

- Read more

- Tuesday April 7th, 2020

K Finance (Clairfield Italy) advisor to Virginio Cassina in the buy of a minority stake of Valetudo

Virginio Cassina Srl, a private investor, acquired a minority stake in Valetudo, a company specialising in the production and distribution of cosmetic and pharmacosmetic products. Details in the “M&A deals” section of the website.

- Read more

- Tuesday March 3rd, 2020

The work of young people: the heritage of SMEs

“Unstable and precarious: this is the image of the work of young people in Italy at the beginning of the Third Millennium. With the highest percentage of youth unemployment in Europe, with a significant misalignment between school education and the needs of businesses, with the difficulty of seeing active policies capable of offering reassuring prospects”....

- Read more

- Monday March 2nd, 2020

Reflections on 15 years of M&A

On the occasion of the 15 years of Clairfield International our Partner Filippo Guicciardi, in collaboration with our Barcelona Partner Brian O’Hare, illustrated the main changes in the M&A world from 2005 to today. Click here to read the article.

- Read more

- Tuesday February 25th, 2020

Giulio Sapelli at the presentation of the new book by Veronica Ronchi “La dimensione giusta – Giovani lavoratori nella PMI italiana”

Giulio Sapelli at the presentation of the new book by Veronica Ronchi “La dimensione giusta – Giovani lavoratori nella PMI italiana”: “Let young people love the SMEs“. The research, presented by the author with the moderation of Francesca Mortaro at the Circolo del Commercio in Milan, with Giulio Sapelli, historian of Economics, Marco Piuri, CEO...

- Read more

- Tuesday February 18th, 2020

K Finance (Clairfield Italy) advisor to SITI B&T Group in the structuring of a long term facility

K Finance (Clairfield Italy) and The European House – Ambrosetti acted as financial advisors to SITI B&T Group in structuring a long term facility of Euro 30 million provided by a pool of three banks, Banco BPM, UniCredit and Cassa Depositi e Prestiti. Details in the “M&A deals” section of the website.

- Read more

- Friday February 14th, 2020

K Finance (Clairfield Italy) advisor to Lanificio dell’Olivo in the sell to Ethica Global Investments

Gradiente Sgr Spa and Firme Spa have sold 100% of Lanificio dell’Olivo, historic producer of fancy knitting yarns in the Prato district, to Ethica Global Investments fund. The shareholders of Lanificio dell’Olivo were assisted by K Finance (Clairfield Italy) as financial advisor. Details in the “M&A deals” section of the website.

- Read more

- Monday February 3rd, 2020

K Finance (Clairfield Italy) at IPEM 2020

K Finance (Clairfield Italy), together with all the other partners of Clairfield International, is present at IPEM 2020, the most important event dedicated to Private Equity in Europe. In the photo the CEO of K Finance, Filippo Guicciardi, at our stand.

- Read more

- Thursday January 30th, 2020

K Finance (Clairfield Italy) advisor to Negri Bossi in the sell to Nissei Plastic Industrial

Kingsbury Luxembourg s.à.r.l., an Ausable Capital Partners portfolio company, sold a majority stake of Negri Bossi S.p.A., an Italian company active in the manufacture and sale of injection moulding machines and robot equipment, to Nissei Plastic Industrial Co., Ltd. K Finance (Clairfield Italy) was advisor to Negri Bossi. Details in the “M&A deals” section of...

- Read more

- Monday January 27th, 2020

K Finance joins Partner 24 ORE

K Finance has been chosen as the national referent for M&A consulting activities (“M&A advisory”) by Partner 24 ORE, the platform launched, organized and managed by Il Sole 24 Ore in order to create the first network of professionals and companies that constitute the excellence in the different categories of activities. We are proud to...

- Read more

- Wednesday January 22nd, 2020

K Finance (Clairfield Italy) advisor to SITI B&T in the buy of Diatex

SITI B&T Group S.p.A. acquired a 75% stake in Diatex S.p.A., a company that produces tools for squaring, cutting and for finishing finished products in the ceramic, natural stone and glass sectors. K Finance (Clairfield Italy) acted as financial advisor to Siti B&T Group. Details in the “M&A deals” section of the website.

- Read more

- Monday January 20th, 2020

The new “Clairfield Outlook 2020” is out

Clairfield International is pleased to announce the publication of our Clairfield Outlook 2020, a look at what’s on the horizon in M&A. As part of our celebration of 15 years since the founding of Clairfield International, this special edition focuses on what has changed in sector activity since 2005—and we also take a good look...

- Read more

- Wednesday January 15th, 2020

K Finance releases the 2019 edition of the research on the attractivity of Italian sectors

K Finance (Clairfield Italy) releases today the 2019 edition of the research on the attractivity of Italian sectors, published today online on “Il Sole 24 Ore+”, in collaboration with the Italian Stock Exchange e Elite. The 2019 edition of the Research brings positive messages: the Technology, Utilities, Travel & Leisure and Oil & Gas sectors...

- Read more

- Thursday December 19th, 2019

K Finance (Clairfield Italy) advisor to Amilon in the sell to Zucchetti

Zucchetti Group has acquired a controlling stake (51%) in Amilon, a leading company in Italy and Europe in supporting companies with the definition of branded currency strategies, the so-called “branded coins”, issued by retail companies in the form of gift cards, loyalty points and coupons. Details in the “M&A deals” section of the website.

- Read more

- Tuesday December 17th, 2019

The right dimension – Young workers in the Italian SME

The book “The right dimension – Young workers in the Italian SME” by Veronica Ronchi, Professor of Political Economy and History of International Economic Relations at the University of Milan, has been published. Through an exciting journey based on in-depth interviews, this essay explores the long journey of yesterday’s young people and today’s young people...

- Read more

- Friday December 13th, 2019

K Finance at the 5th Italian Private Equity Conference

The panel of the 5th Italian Private Equity Conference of Private Equity Insights, attended this morning by the CEO of K Finance (Clairfield International) Filippo Guicciardi, was very interesting. “There is a strong differentiation,” said Guicciardi, “in the mega deal and mid-market markets. Indeed there has been a contraction of mega deals for a number...

- Read more

- Thursday October 24th, 2019

Let’s twenty: the emotional video!

#kfparty20 With more than 500 friends, K Finance celebrated its first 20 years at the San Siro racecourse in Milan. Thanks to the K Finance team, thanks to all the friends who took part, thanks to Associazione CAF Onlus for being there, thanks to those who helped us in a thousand ways: we had fun...

- Read more

- Monday October 7th, 2019

K Finance (Clairfield Italy) advisor to Lazzerini in the sell to B4

B4 Investimenti SGR S.p.A. acquires control of Lazzerini, a historic company active on a global scale in the design, production and marketing of passenger seats (and components) for means of transport (mainly buses), through the fund B4 H II – EuVECA Fund, via a a buy-out operation in partnership with the company’s top managers. Details...

- Read more

- Tuesday October 1st, 2019

K Finance (Clairfield Italy) advisor to Italpol in the sell of its business unit to Mondialpol

The Mondialpol Group, a historical and strongly-established brand in Security Services and Cash Handling in Italy, and the company Italpol Group, regional leader for Security Services in the Friuli-Venezia Giulia region of Northern Italy, have completed a project of industrial integration between the two groups, by transferring the business unit of Italpol to Vedetta2Mondialpol. Details...

- Read more

- Tuesday September 3rd, 2019

K Finance (Clairfield Italy) advisor to Rototech in the sell to Quadrivio Group

K Finance (Clairfield Italy) was financial advisor to Rototech in the sell to Quadrivio Group. Details in the “M&A deals” section of the website.

- Read more

- Wednesday July 31st, 2019

K Finance (Clairfield Italy) has supported the management of Zambon in the acquisition of Breath Therapeutics

K Finance (Clairfield Italy) has supported the management of Zambon in the acquisition of Breath Therapeutics. Details in the “M&A deals” section of the website.

- Read more

- Tuesday July 30th, 2019

K Finance (Clairfield Italy) advisor to Sacchi in the acquisition of DEMO

K Finance (Clairfield Italy) acted as financial advisor to Sacchi, leader in the market for the distribution of electrical equipment, in the acquisition of DEMO. Details in the “M&A deals” section of the website.

- Read more

- Thursday June 20th, 2019

K Finance (Clairfield Italy) best advisory firm for cross border deals with Private Equity funds

K Finance (Clairfield Italy) wins the Global Awards 2019 of Corporate INTL for “Cross Border Private Equity Transactions Advisory Firm of the Year in Italy“. “We’re very proud of this award”, says CEO Filippo Guicciardi, “that attests our strong positioning with the Private Equity funds in Italy for cross border transactions. Congratulations to all the...

- Read more

- Thursday April 4th, 2019

K Finance (Clairfield Italy) advisor to Grupo GSS in the sale to Covisian

The Spanish company Grupo GSS, specialized in customer management services, was bought by Covisian, an Italian company leader in business process outsourcing services and innovative customer care solutions. K Finance (Clairfield Italy) and Clairfield Spain were advisor to Grupo GSS. Details in the “M&A deals” section of the website.

- Read more

- Tuesday February 26th, 2019

K Finance (Clairfield Italy) advisor to Limonta Sport in the sell to SLG

SLG, a Belgian group acquired by SLG management and Chequers Capital in June 2017, specialized in the development, production and sale of artificial turf for sports and leisure applications, acquired Limonta Sport. Details in the “M&A deals” section of the website.

- Read more

- Tuesday January 29th, 2019

K Finance (Clairfield Italy) releases today the 2018 edition of the research on Italian provinces’ value creation

K Finance (Clairfield Italy) releases today the 2018 update of its research on value creation in Italian provinces published in “Il Sole 24 Ore”, in collaboration with Borsa Italiana and Bureau Van Dijk. Rome, Cuneo and Naples. It is an unexpected trio that appears on the podium of the financial attractiveness of the provinces. Milan...

- Read more

- Monday January 14th, 2019

K Finance (Clairfield Italy) best Mid-Market M&A Team

K Finance, partner of Clairfield International, wins the Team of the year Mid-Market M&A award at the Financecommunity Awards 2018. This is the reason: “It is a motivated and focused team, appreciated also by its competitors. Over the past year it has experienced strong growth and has participated in many crossborder transactions“. The Financecommunity Awards,...

- Read more

- Tuesday November 20th, 2018

K Finance (Clairfield Italy) advisor to Star Capital and the other shareholders in the sell of Olivotto Glass technologies to the Chinese group CGH

Olivotto Glass Technologies, an Italian company active in the design, engineering, production and sale of machines and plants for the manufacturing of hollow glass items, has been sold to the Chinese group China Glass Holdings, listed on the Hong Kong Stock Exchange (HKG:3300). Details in the “M&A deals” section of the website.

- Read more

- Monday November 5th, 2018

K Finance (Clairfield Italy) advisor to Gruppo FIMO in the purchase of DCE

Group FIMO, an international leader in the manufacturing and distribution of telecom cable management products and camouflage systems, controlled since 2015 by the fund IGI Investimenti Cinque managed by the Private Equity company IGI Private Equity, has acquired DCE, an Italian company specialized in the realization of systems and wiring for the telecommunication industry. Details...

- Read more

- Wednesday October 31st, 2018

K Finance (Clairfield Italy) advisor to Star Capital and the founding members of Gia in the sale to Ethica Global Investments

Star Capital SGR and the minority shareholders sold a majority stake of Gia, an Italian company active in the design, production and sale of patented fixing solutions for the ITS industry, to Ethica Global Investments. Details in the “M&A deals” section of the website.

- Read more

- Monday October 29th, 2018

Packaging Insider – October 2018

Available from today, you can download at the following link the new issue of the Packaging Insider, produced by Clairfield International, that reviews all the statistics of the packaging industry of the last six months: Packaging Insider – Clairfield International – October 2018

- Read more

- Thursday October 25th, 2018

K Finance (Clairfield Italy) advisor to Convert Italia in the sale to Valmont Industries

Convert Italia SpA, an Italian company active in the design, engineering, production and sale of single-axis trackers for photovoltaic systems, sold 75% of its share capital to the American listed group Valmont Industries Inc. (NYSE:VMI). Details in the “M&A deals” section of the website.

- Read more

- Friday August 3rd, 2018

K Finance (Clairfield Italy) advisor to Farina Presse in the sale to Schuler

Schuler AG, member of the Andritz Group, acquired 100% of Farina Presse, the Italian manufacturer of presses and hot forging lines based in Suello (LC). Details in the “M&A deals” section of the website.

- Read more

- Wednesday August 1st, 2018

K Finance (Clairfield Italy) advisor to icP in the sale to Cartiera dell’Adda

Industria Cartaria Pieretti, an historic company based in Lucca and active in the production of recycled paper and cardboard for industrial use, sold 80% of its share capital to Cartiera dell’Adda. Details in the “M&A deals” section of the website.

- Read more

- Tuesday July 31st, 2018

K Finance (Clairfield Italy) advisor to Openjobmetis in the purchase of HC Human Connections

Openjobmetis SpA, an employment agency listed on the Borsa Italiana MTA, has acquired 70% of the share capital of HC Human Connections Srl. Details in the “M&A deals” section of the website.

- Read more

- Wednesday July 25th, 2018

K Finance (Clairfield Italy) advisor to Panini Durini in the sell to Astraco

Pancioc Spa, a company active in the management of the lunch bar chain “Panini Durini” has been acquired by a pool of investors lead by Astraco and to Fondo Impresa Italia managed by Riello Investimenti Partners. Details in the “M&A deals” section of the website.

- Read more

- Wednesday July 11th, 2018

Clairfield International Milano Meeting 2018: the video

Clairfield Annual Partners Meeting Milan 2018 and Reflections on M&A Market from Clairfield International on Vimeo.

- Read more

- Friday June 29th, 2018

K Finance (Clairfield Italy) advisor to EDIF in the sell to Sonepar of the Puglia business

Sonepar Italia S.p.A., a leading company in the wholesale distribution of electrical materials in Italy, controlled by the French multinational group Sonepar, acquired the Puglia-based business unit of EDIF S.p.A., consisting of the Barletta, Foggia and Modugno points of sale, generating together a total turnover of more than Euro 20 million in 2017. Details in...

- Read more

- Thursday June 21st, 2018

K Finance (Clairfield Italy) advisor to Openjobmetis in the acquisition of Meritocracy

Openjobmetis S.p.A., an employment agency listed on the Borsa Italiana MTA, has acquired 100% of the share capital of Coverclip S.r.l., owner of the online platform Meritocracy. Details in the “M&A deals” section of the website.

- Read more

- Tuesday June 5th, 2018

Thank you from K Finance and Clairfield!

Our video to thank all our partners and friends who took part to our two day Clairfield International meeting in Milan! Thank you!

- Read more

- Monday June 4th, 2018

Clairfield International partners gather in Milan

Clairfield International held its most recent partner meeting in Milan on May 24-25, 2018, organized by the local Italian partner K Finance. Partners and colleagues from 22 countries gathered both for presentations from experts in the financial community on the sector’s most pressing issues and for discussing internal best practices and evaluating outlooks. The sessions...

- Read more

- Wednesday May 30th, 2018

Packaging Insider – May 2018

Available from today, you can download at the following link the new issue of the Packaging Insider, produced by Clairfield International, that reviews all the statistics of the packaging industry of the last six months: Packaging Insider – Clairfield International – May 2018

- Read more

- Monday May 28th, 2018

New corporate video

Our new corporate video is online, you can see it in the homepage of the website.

- Read more

- Tuesday May 8th, 2018

CEO IS PRESENT #FILIPPOGUICCIARDI

K Finance CEO, Filippo Guicciardi, will be interviewed by da Mariangela Pira Monday May 7 at 7pm at OPEN Milano, for a project created by Giorgio Fipaldini that aims to discover how a creative initiative is typical of leaders of companys that innovate.

- Read more

- Friday May 4th, 2018

Filippo Guicciardi at Caffè BeBeez

Filippo Guicciardi, CEO of K Finance, guest at Caffè BeBeez lead by Stefania Peveraro, together with Stefano Ghetti, partner of WISE SGR, update us on today’s situation of crossborder M&A and the new scenarios for the Italian enterprises. Here you can find a brief extract (in Italian):

- Read more

- Friday April 27th, 2018

Clairfield Annual Review 2018

The Clairfield Annual Review 2018 has now been published. It gives an interesting insight of our market, international M&A, with analysis and data on all the major sectors. By clicking on the image you’ll have access to the whole document.

- Read more

- Friday March 2nd, 2018

K Finance (Clairfield Italy) advisor to Chiorino Technology in the sell to Arcadia SGR

Chiorino Technology, active in the high-quality leather products coating process for top luxury brands, has been sold to a PE fund managed by Arcadia SGR. Details in the “M&A deals” section of the website.

- Read more

- Wednesday February 28th, 2018

K Finance (Clairfield Italy) and Clairfield France advisor to Group Fimo in the purchase of Polyform

Group FIMO, an international leader in the manufacturing and distribution of telecom cable management products, has acquired Polyform SA, a French company specialized in the realization of camouflage solutions for the mobile industry. Details in the “M&A deals” section of the website.

- Read more

- Wednesday December 13th, 2017

K Finance releases today the 2017 edition of the research on the attractivity of Italian sectors

K Finance (Clairfield Italy) releases today the 2017 edition of the research on the attractivity of Italian sectors, published today on “Il Sole 24 Ore”, in collaboration with the Italian Stock Exchange. Technology, media and tourism are on top, food and raw materials are at the end of the list. Click here for the article...

- Read more

- Monday December 11th, 2017

Packaging Insider – October 2017

Available from today, the new you can download at the following link the new issue of the Packaging Insider, produced by Clairfield International, that reviews all the statistics of the packaging industry of the last six months: Packaging_Insider_Clairfield_International_201710

- Read more

- Tuesday October 24th, 2017

K Finance (Clairfield Italy) advisor to DS Data Systems in the sell to Zucchetti

The leading Italian software group, Zucchetti spa, acquired a majority stake of DS Data systems (UK) Ltd., a company operating between UK and Italy, developer and owner of KonaKart, a highly successful Java-based B2C and B2B eCommerce software product. Details in the “M&A deals” section of the website.

- Read more

- Monday September 18th, 2017

K Finance (Clairfield Italy) advisor to Veronagest in the sell to F2i

Veronagest sold a wind portfolio, comprising seven energy plants operating in Sicily and Calabria with aggregate installed capacity of 282 MW, to F2i’s Secondo Fondo. Details in the “M&A Deals” section of the website.

- Read more

- Friday September 1st, 2017

K Finance (Clairfield Italy) advisor to ATOP in the sell to Charme and IMA

ATOP, world leader in the manufacturing of automatic lines for the production of electric motors for various industrial and automotive applications was sold to Charme Capital Partners SGR and IMA. Details in the ‘M&A deals’ section of the website.

- Read more

- Wednesday May 24th, 2017

K Finance, in-depth analysis on Italian enterprises’ equity, release 2017

K Finance’s, Italian partner of Clairfield International, research on Italian enterprises’ equity. Download it (in Italian) from the ‘Services – Researches’ section of the website.

- Read more

- Monday May 22nd, 2017

K Finance’s research on Italian enteprises’ equity

Il Sole 24 Ore Click here for the article (in Italian) here

- Read more

- Monday May 22nd, 2017

Clairfield Review H1 2017

Clairfield International Download document

- Read more

- Friday January 27th, 2017

The Indian group WAAREE acquires the Italian Cesare Bonetti Spa

K Finance Download file

- Read more

- Wednesday July 3rd, 2013

K Finance (Clairfield Italy) advisor to Ersel and to the other shareholders in the sell of Sicme Motori to Orange1

Orange1 Holding buys Sicme Motori and becomes leader in the industry of industrial electric motors. Details in the ‘M&A deals’ section of the website.

- Read more

- Thursday May 18th, 2017

K Finance advisor to Marsilli & Co. in the investment of Fondo Italiano

Download file

- Read more

- Monday April 22nd, 2013

K Finance takes part in STAR CONFERENCE 2013 of Borsa Italiana

Download file

- Read more

- Friday March 22nd, 2013

K Finance advisor to Tubinoxia in the increase of its share ownership of OSTP

K Finance Download file

- Read more

- Tuesday January 22nd, 2013

K Finance: SMEs, more capital to try a relaunch

Il Sole 24 Ore Download file

- Read more

- Monday January 19th, 2015

K Finance advisor to Bitolea in the sell of a majority stake to Clessidra

K Finance Download file

- Read more

- Tuesday June 12th, 2012

EIRE 2012: K Finance reports on the new credit scenarios

K Finance Download file

- Read more

- Thursday June 7th, 2012

M&A: food and abroad investments are 2013 trends

K Finance Download file

- Read more

- Tuesday February 5th, 2013

K Finance in one of the case histories of the book M&A: Italian stories of success

K Finance Download file

- Read more

- Wednesday April 4th, 2012

K Finance Report on Italian industry 2012 on Milano Finanza

Milano Finanza Download file

- Read more

- Thursday March 15th, 2012

K Finance advisor to the listed Brasilian Company Industrias Romi in the buy of Burkhardt+Weber from Gruppo Riello Sistemi

K Finance Download file

- Read more

- Thursday February 2nd, 2012

K Finance presents two new reports during STAR Conference 2012

K Finance Download file

- Read more

- Monday March 26th, 2012

K Finance (Clairfield Italy) advisor to ItalGlobal Partners in the sell of CMI to Guangdong SACA

ItalGlobal Partners sold CMI, of which it owned 70%, to Guangdong Xingye Investment LLC, which is the controller of the listed Chinese Group Guangdong SACA. Details in the ‘M&A deals’ section of the website.

- Read more

- Tuesday May 16th, 2017

K Finance advisor to B810 in the purchase of Digicom

B810 bought 100% of Digicom. Details in the ‘M&A deals’ section of the website.

- Read more

- Wednesday May 10th, 2017

K Finance advisor to IMR in the purchase of Industrialesud

IMR Automotive S.p.A. (´IMR´), a world-class supplier in the manufacturing of exterior parts for the luxury cars and truck industry, acquired 81.25% of Industrialesud S.p.A. (´IS´), an Italian company active in the same industry. The remaining 18.75% has been acquired by Simest S.p.A., Cassa Depositi e Prestiti arm, focused on supporting Italian Enterprises. Details in...

- Read more

- Tuesday March 28th, 2017

K Finance 2017 reserach on Italian provinces value creation

In the ‘Ricerche‘ section you can download the 2017 research on vale creation in the Italian provinces.

- Read more

- Monday February 13th, 2017

K Finance advisor to Tholos in the sell to Elettra Investimenti

Elettra Investimenti S.p.A., an Italian industrial holding which develops projects in the energy sector with particular expertise in cogeneration and trigeneration plants, listed on the Italian AIM, has agreed to acquire Tholos S.r.l. from its parent company Dromos Holding S.rl. Details in the ‘M&A deals’ section of the website.

- Read more

- Wednesday December 21st, 2016

Create value for the company through corporate finance

This was the theme of a meeting in Parma where Giuseppe R. Grasso, Chairman of K Finance, and Filippo Guicciardi, CEO of K Finance, talked about the main topic of the day. Watch the video (in Italian). http://youtu.be/T_8q7JbbvE0

- Read more

- Wednesday October 19th, 2016

Ravaglioli Group Sold to Dover Corporation

Samiro Group S.p.A., holding company of Ravaglioli Group (“Ravaglioli”), announced today to have sold the entire stake of the company to the American group Dover Corporation (NYSE:DOV), a global company with a business that is active in the production of vehicle service equipment. Detail in the ˝M&A deals˝ section of the website.

- Read more

- Monday October 3rd, 2016

K Finance advisor to Jolly Scarpe in the sell to Minerva-Robusto

Minerva-Robusto, a Swiss manufacturer of military safety shoes, has acquired from the Italian private equity fund Aksia Group Jolly Scarpe S.p.A., an Italian manufacturer of safety technical shoes for Military, Law Enforcement and Firefighters use. Details in the ˝M&A deals˝ section.

- Read more

- Friday September 30th, 2016

K Finance (Clairfield Italy) advisor to ACS Dobfar in an underwriting deal

ACS Dobfar, an Italian chemical-pharmaceutical group leader worldwide in the manufacturing of Active Pharmaceuticals Ingredients (APIs) and Final Dosage Forms (FDFs) in the antibiotic sector worldwide, received a Eur 175 million term loan financing through an underwriting deal closed with Unicredit and Natixis in Italy. K Finance (Clairfield Italy) assisted ACS Dobfar in the preparation...

- Read more

- Thursday September 1st, 2016

K Finance (Clairfield Italy) advisor to Emozione3 (Wish Days) in the sale to Smartbox Group

Smartbox Group, the pioneer of experience gifts, reinforces its position as the market leader in Italy and Europe with the acquisition of Wish Days. Details in the ´M&A deals´ section.

- Read more

- Tuesday April 12th, 2016

K Finance (Clairfield Italy) advisor to FIAC in the sell to Atlas Copco

Atlas Copco, a leading provider of sustainable productivity solutions, has agreed to acquire from the Lucchi Family FIAC S.p.A., an Italian manufacturer of piston compressors and related equipment with a global sales network. Details in the ´M&A deals´ section.

- Read more

- Wednesday January 27th, 2016

K Finance (Clairfield Italy) and Clairfield France advisor to Groupe RG in the acquisition of A+A Monferrato

Groupe RG, a French leading distributor in the field of Personal Protective Equipment (PPE), backed by PE fund Abenex, enters the Italian market through the acquisition of the Italian company A+A Monferrato. Details in the ´M&A deals˝ section.

- Read more

- Friday January 22nd, 2016

K Finance (Clairfield Italy) advisor to One Express in the sale of a minority stake

One Express Spa, a company specialized in express delivery transport of palletized freight, sold a minority stake to 20 member companies of its network. K Finance, member of Clairfield International, acted as financial advisor to OneExpress in this transaction. Details in the ˝M&A deals˝ section.

- Read more

- Friday November 27th, 2015

K Finance (Clairfield Italy) and Clairfield Germany advisors to Safil and GTI in the sale to Südwolle

Südwolle Group, a leading global producer of worsted yarn for weaving, circular and flat knitting in pure wool and wool blends, announced that it has acquired a 100% stake in Safil S.p.A. as well as an 80% stake in Gruppo Tessile Industriale (GTI) S.p.A., both Italian based worsted yarn manufacturers. K Finance was advisor to...

- Read more

- Friday November 6th, 2015

K Finance (Clairfield Italy) and Orbis Partners (Clairfield UK) advisor to Raccortubi in the buy of Norsk Alloys

Raccortubi Group, active in Italy and worldwide with its own manufacturing and distribution companies for piping material in special steels for the petrochemical industry, announces the acquisition of 100% of the capital of Norsk Alloys Ltd on today’s date. The acquired company is based in Aberdeen, Scotland, and has a lengthy experience in the distribution...

- Read more

- Tuesday October 27th, 2015

K Finance advisor to Saet in the sell to ParkOhio

The US Group ParkOhio (NASDAQ: PKOH) has acquired, from Italy based private equity Star Capital and other minority shareholders, SAET S.p.A. headquartered in Turin, Italy for Euro18.4 million in cash. Details in the ˝M&A˝ deals section.

- Read more

- Friday December 12th, 2014

K Finance (Clairfield Italy) and Clairfield Germany advisors to Rollon in the take over of the German company Hegra

Rollon, the international group based in Vimercate, world leader in the production of linear motion systems for various sectors, from railways to aerospace, machine tools and medical equipment, has taken over the German company Hegra which specialises in the production of telescopic and linear guides. Details in the ˝M&A deals˝ section.

- Read more

- Tuesday October 13th, 2015

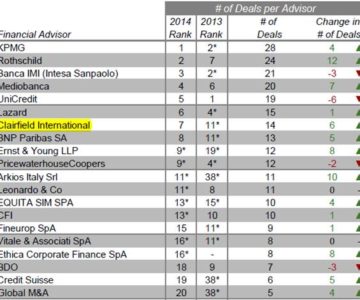

Thomson Reuters League Tables: K Finance 7th in Italy

K Finance, Italian partner of Clairfield International, is 7th in Italy (1st of the independent advisors) for number of closed deals in 2014, according to Thomson Reuters League Tables. Clairfield International is 9th in Europe.

- Read more

- Tuesday January 27th, 2015

K Finance: SMEs, more capital to try a relaunch

Click here to read the article (in Italian)

- Read more

- Monday January 19th, 2015

K Finance advisor to Raccortubi in the sell to Synergo

Raccortubi sold a minority stake to the fund Synergo. The sell was made in order to finance the acquisition of Petrol Raccord. Details in the ˝M&A deals˝ section.

- Read more

- Friday January 9th, 2015

K Finance advisor to Raccortubi in the acquisition of Petrol Raccord

Raccortubi S.p.A. acquired 100% of the share capital of the Italian company Petrol Raccord S.p.A. K Finance, member of Clairfield International, acted as financial advisor to the buyer. Details in the ˝M&A deals˝ section.

- Read more

- Friday January 9th, 2015

K Finance´s analysis on Italian sectors´ appeal on Il Sole 24Ore

Click here to read the article (in Italian)

- Read more

- Monday December 22nd, 2014

K Finance for Confindustria Modena: which future for the enteprises after the earthquake?

˝Doing business in the North Area. From the crisis to the aftermath of the earthquake˝. This is the title of the new analysis carried out by K Finance on the Modena province. You can download the research in the ˝Researches˝ section while here you find a link to an interview to Mr Grasso on the...

- Read more

- Friday December 5th, 2014

K Finance advisor to Vetriceramici in the sale to Ferro Corporation

Ferro Corporation (NYSE: FOE, “Company”) bought from Milan, Italy-based Private Equity Funds’ Management Company Star Capital SGR S.p.A. and from two minority owners Italy-based Vetriceramici S.p.A. Details in the ˝M&A deals˝ section.

- Read more

- Thursday December 4th, 2014

K Finance advisor to Automa in three deals

Automa Spa sold three of its four divisions to different buyers. K Finance was advisor to Automa in all the deals. Details in the ˝M&A deals˝ section.

- Read more

- Friday November 28th, 2014

Private investors sold 100% of their shares in Drorys Group to the managers of the company

K Finance, Italian partner of Clairfield International, acted as financial advisor to the sellers. Details in the ˝M&A deals˝ section of the website.

- Read more

- Thursday September 18th, 2014

Filippo Guicciardi from Cernobbio: ˝M&A is doing good, especially cross-border˝

Filippo Guicciardi is interviewed from ClassCNBC at the 40th edition of the annual Ambrosetti Workshop that takes place in Cernobbio, Lake Maggiore. In this video, Filippo Guicciardi, K Finance CEO, tells us the ˝sentiment˝ that surrounds the M&A market in these days.

- Read more

- Monday September 15th, 2014

K Finance advisor to Bidvest in the buy of Gruppo DAC

The South African company Bidvest bought a majority stake of the Italian Gruppo DAC. K Finance advised Bidvest. The details in the ˝M&A deals˝ section of the website.

- Read more

- Thursday July 10th, 2014

K Finance advisor to IMR Automotive in the buy of the German company FPK Lightweight Technologies

IMR Automotive S.p.A., a world-class supplier in the manufacturing of exterior parts for the automotive and truck industry, has acquired 100% of FPK Lightweight Technologies Deutschland GmbH, a German company active in the same industry, with a particular focus on the designing and manufacturing of composite lightweight structures and aerodynamic components, with 2013 sales in...

- Read more

- Wednesday June 11th, 2014

Second edition of K Finance´s research on Italian provinces value creation

Today´s Il Sole 24 Ore publishes the second edition of K Finance´s research, in collaboration with Borsa Italiana, on Italian provinces value creation, focussed this year on 2011-2012: Napoli on top, Ravenna in the last position. The research is free to download in the ˝Researches˝ area of the website. Here´s the link to the article.

- Read more

- Monday June 9th, 2014

K Finance advisor to DEI in the sell to Elfi

K Finance advised the owners of DEI Srl in the sale of 100% of their shares to ELFI spa. Thanks to the transaction, Elfi will reach EUR 100 million in annual revenues, becoming one the most important players in the wholesale distribution of electric materials in Northern Italy. Details in the ˝M&A deals˝ section.

- Read more

- Monday May 12th, 2014

K Finance 1st in Italy according to Thomson Reuters league tables

K Finance, the Italian partner of Clairfield International, is at number 1 in Q1 2014 of Thomson Reuters Small Cap league tables according to number of deals and Clairfield International is 6th in Europe. After the 8 deals closed in 2013, this is effectively a good start of year for K Finance.

- Read more

- Thursday April 10th, 2014

K Finance at STAR Conference 2014

K Finance takes part for the tenth time to STAR Conference, the event dedicated to the companies listed on the STAR Segment of Borsa Italiana, to the international investors and to the whole financial community. Come and join us at our stand, Tuesday 25 and Wednesday 26 March 2014.

- Read more

- Saturday May 20th, 2017

K FINANCE ADVISOR TO LEDIBERG IN THE DEBT RESTRUCTURING

Lediberg Spa, a group leader in the paper and printing industry, has been the target of an investment of a pool of Italian and foreigner investors interested in the growth of the business. The deal has reduced the financial debt of the group through a capital increase of 60 million Euro and an agreement of...

- Read more

- Friday February 28th, 2014

K FINANCE GETS STRONGER IN THE USA

Four new offices in four US key cities will join the already active New York office: Minneapolis, Atlanta, Phoenix and Seattle. From February 1, 2014, Greene Holcomb & Fisher (www.ghf.net) has entered the partnership Clairfield International (www.clairfield.com), of which K Finance is a founding member and partner for Italy. Founded 20 years ago, GHF has...

- Read more

- Wednesday February 12th, 2014

K Finance advisor to IMR Automotive in the buy of the German company Sommer

IMR Automotive S.p.A. (“IMR”), a world-class supplier in the manufacturing of exterior parts for the automotive and truck industry, has acquired 100% of Sommer Industrielackierung GmbH (“Sommer”), a German company active in the painting business, mainly for the automotive sector, with 2013 sales in the range of Euro 15 Million. Details in the ´M&A deals´...

- Read more

- Friday February 7th, 2014

K FINANCE ANALYSIS ON ITALIAN SECTORS´ APPEAL ON IL SOLE 24ORE

Click here to read the article (in Italian)

- Read more

- Monday December 23rd, 2013

KF Conversation, instructions on minibonds

In this new meeting of K Finance´s videoforum ´KF Conversation˝, Giuseppe R. Grasso and Filippo Guicciardi talk with Gabriele Gori, Banca MPS Corporate Area Responsible, about minibonds.

- Read more

- Tuesday November 5th, 2013

K Finance advisor to Indústrias Romi SA in the sale of the Sandretto business to a pool of Italian entrepreneurs

As part of the voluntary liquidation of Romi Italia, the Sandretto business, historical Italian brand of injection moulding machines for plastic, has been sold to a pool of Italian entrepreneurs, gathered under the newco Scout One, controlled by the listed company Photonike. Details in the ˝M&A˝ section of the website.

- Read more

- Friday September 20th, 2013

Filippo Guicciardi from Cernobbio: ˝M&A will play a role in the exit from the crisis˝

Filippo Guicciardi is interviewed from ClassCNBC at the annual Ambrosetti Workshop that takes place in Cernobbio, Lake Maggiore. In this video, Filippo Guicciardi, K Finance CEO, tells us the ˝sentiment˝ that surrounds the M&A market in these days. http://youtu.be/EPk4whB8RvQ

- Read more

- Thursday September 19th, 2013

K Finance advisor to Consorzio Assoutility in the sale of Axopower to the managers

Consorzio Assoutility has sold Axopower’s shares to Ambrosiana Energia, a company participated by Ambrogest and the three managers of Axopower. Details in the ˝M&A deals˝ section of the website.

- Read more

- Friday September 13th, 2013

Filippo Guicciardi at ˝Caffè Affari˝ takes a look at M&A in the first semester

˝There´s still a lot of uncertainty and the M&A market is thorn between positive impulses and global outlook problems˝. These are K Finance CEO Filippo Guicciardi´s thoughts, interviewed during the programma ˝Caffè Affari˝ on CNBC lead by Mariangela Pira. After the first six months, the analysis on the M&A market and on Italy forecast a...

- Read more

- Monday July 29th, 2013

K Finance advisor to Autoneum AG in the sell to mutares AG of their Italian company

K Finance has been advisor to the listed Swiss automotive parts group Autoneum Holding AG in the sell of Autoneum Italy to mutares AG, the German based listed investment company based in Munich. All the details in the ˝M&A deals˝ section of the website.

- Read more

- Tuesday July 23rd, 2013

K Finance´s research on Italian provinces value creation

Today´s Il Sole 24 Ore publishes K Finance´s research, in collaboration with Borsa Italiana, on Italian provinces value creation in 2009-2011: Bologna on top, Varese in the last position. The research is free to download in the ˝Researches˝ area of the website. Here instead you can find the article (in Italian).

- Read more

- Saturday May 20th, 2017

KF Conversation, second episode of the video forum

KF Conversation is a new video forum where the leading Italian entrepreneurs and financial people give their views about the issues on which the top managers have to take decisions on. Today´s guest of KF Conversation is Massimo Candela, CEO of F.I.L.A., that has met Giuseppe Renato Grasso and Filippo Guicciardi, President and CEO of...

- Read more

- Thursday May 23rd, 2013

K Finance advisor to Marsilli & Co. in the investment of Fondo Italiano

Private Equity Investor Fondo Italiano di Investimento has injected Euro10m into winding and automatic assembly systems provider Marsilli & Co in exchange for a minority stake. K Finance has been advisor to Marsilli. Details in the ˝M&A deals˝ section of the website.

- Read more

- Monday April 22nd, 2013

K Finance at STAR conference 2013: more ˝Borsa˝ with project ˝Elite˝

Filippo Guicciardi, K Finance CEO: ˝The presnetation of the financial data of the listed companies ia s very good sign of a healthy market and in our role of strategic advisor we do note a growing attention to the the Stock Exchange˝. STAR Conferencee 2013 hit the goals: attention towards M&A deals, mostly focussed on...

- Read more

- Monday April 8th, 2013

K Finance takes part in STAR CONFERENCE 2013 of Borsa Italiana

K Finance is going to take part in STAR CONFERENCE 2013 that will take place at Borsa Italiana in Milano on March 26 and 27, 2013. K Finance stand will offer the chanche to have a direct contact with people directly involved in the financial and M&A markets. According to K Finance analysis, the opportunities...

- Read more

- Friday March 22nd, 2013

KF Conversation, a new video forum

KF Conversation is a new video forum where the leading Italian entrepreneurs and financial people give their views about the issues on which the top managers have to take decisions on. The first guest of KF Conversation is Andrea Lovato, Techint Industrial Corporation Group Strategic Planning Business Development and ICT Senior Vice President, that has...

- Read more

- Tuesday March 12th, 2013

CLAIRFIELD: NEW PARTNER IN NORWAY

Steinvender AS has joined Clairfield as its exclusive partner in Norway. It becomes the 18th firm in the Clairfield corporate finance partnership and the third in the Nordic region. Steinvender ranks among the top three corporate finance boutiques in Norway in the industry league tables. The firm was founded in 2000 with a focus on...

- Read more

- Wednesday February 22nd, 2012

M&A in a box

According to a K Finance study, the key sector for M&A will be high quality food.

- Read more

- Monday February 18th, 2013

Filippo Guicciardi on M&A trends in 2013

Filippo Guicciardi, CEO of K Finance, interviewed during Caffè Affari in ClassCNBC, talks about M&A 2012 and the trends for 2013. http://youtu.be/TRGO7rf2W5w

- Read more

- Thursday January 31st, 2013

Filippo Guicciardi interviewed on ˝new normality˝

Filippo Guicciardi, CEO of K Finance, interviewed on ClassCNBC, talks about managing the business in times of ˝new normality˝. http://youtu.be/_PRsVSpbfp4

- Read more

- Wednesday January 30th, 2013

K Finance advisor to Tubinoxia in the increase of its share ownership of OSTP

Tubinoxia S.r.l. has as of the 18th of January 2013 taken up its option to increase its shareholding in OSTP from 36% to 51%. Outokumpu remains the minority owner in OSTP with a 49% shareholding. Tubinoxia is a company belonging to the family of Mr Andrea Gatti. K Finance has advised Mr Gatti. Please find...

- Read more

- Tuesday January 22nd, 2013

Giuseppe R. Grasso speaker with Oscar Giannino on the security industry issues

During the “Sicurezza” exhibition that takes place in Milano from 7 to 9 of November 2012, Mr Grasso, President of K Finance and KF Economics, will join the meeting “Gli Stati Generali della sicurezza” (Security: where do we stand). The meeting will be led by Mr Oscar Giannino, journalist and economist. Then, in the afternoon,...

- Read more

- Tuesday November 6th, 2012

K Finance partner of ˝Elite˝, an initiative by Borsa Italiana

K Finance, being a ˝Partner Equity Markets˝ of Borsa Italiana, is an Advisor in the ˝Elite˝ intiative by Borsa Italiana. ˝Elite˝ is designed for the best Italian companies, and features a three-phase-program that helps them plot the course to success: get ready, get fit, get value. http://elite.borsaitaliana.it/partner-elite/partner-equity-markets

- Read more

- Friday October 19th, 2012

Filippo Guicciardi at ClassCNBC on the economic outlook for 2012 H2

Europe is at a crossroad. H2 2012 looks very difficult. Filippo Guicciardi reviews the economic situation. http://youtu.be/1_1PAA594Uk

- Read more

- Monday September 3rd, 2012

Giuseppe R. Grasso interviewed at Forum Credit Management 2012

Giuseppe R. Grasso, interviewed at Forum Credit Management 2012, tells what are the best solutions for a company to get a good line of credit. http://youtu.be/wrJCuy_T18w

- Read more

- Tuesday July 3rd, 2012

Filippo Guicciardi talks about the entrepreneur’s loneliness

New video on K Finance YouTube channel. In ´Caffè Affari´ on ClassCNBC Filippo Guicciardi talks about the crisis and the entrepreneur´s loneliness. http://youtu.be/SU9_dau-xdM

- Read more

- Thursday June 21st, 2012

K Finance advisor to Bitolea Chimica Ecologica in the sell of a majority stake to Clessidra

The fund Clessidra has acquired a majority stake of Bitolea Chimica Ecologica. The Intini family, founder of the business in 1978, remains in charge of the company. Details in the websiste section ˝M&A deals˝.

- Read more

- Wednesday June 13th, 2012

EIRE 2012: K Finance reports on the new credit scenarios